We help DOCTORS get locum and permanent jobs in Australia.

We help DOCTORS get locum and permanent jobs in Australia.

For over 10 years, we’ve helped doctors around the world get work in hospitals all across Australia.

Our services help you maximise your career progression and earning potential, and skip common mistakes that could cost you a lot of time, money, and lost opportunities.

Explore locum and permanent positions across Australia.

Accredited Medical Locum Agency

Work as a doctor in Australia: Where do you start?

Your step-by-step process to move to Australia as an IMG: We can help

“When I was initially looking for information about a move to Australia, I spent so much time scrolling through useless web pages and making phone calls to government agencies seeking answers to my questions, which they couldn’t or wouldn’t give me.

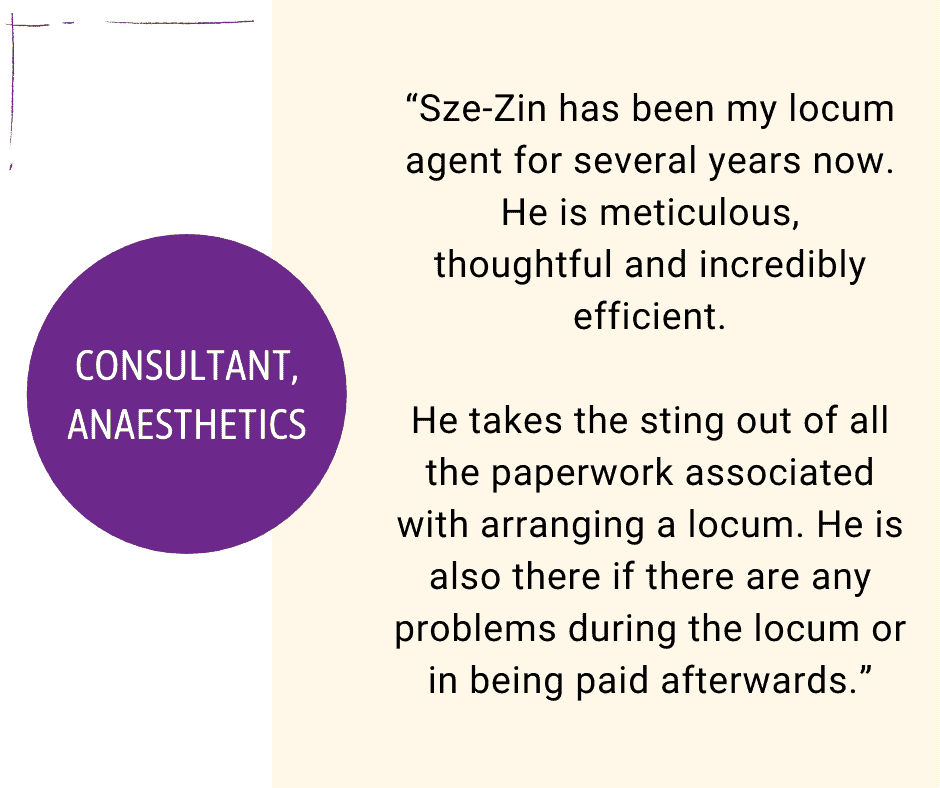

Then I found Sze-Zin and I was blown away by the in depth knowledge that he has regarding Australian hospitals, the registration and recruitment process, immigration policies and pretty much every other fine detail that I needed to answer in order to successfully make a move to Australia. It is very clear that Sze-Zin has an excellent understanding of every aspect of practicing as a physician in Australia and he is well connected in the medical industry.

He always answered any question I had promptly and in great detail, which enabled me to move forward with ease and confidence. Thank you again Sze-Zin!”

– Canadian Anaesthesiologist

Founder and Primary Consultant,

Sterling Healthcare Resourcing

Why work as a doctor in Australia?

Being a doctor in Australia is a highly respected profession where you have the potential to earn an excellent living and job conditions. You and your family may also get access to world-class public and private health care.

Doctors enjoy world-class education, training and opportunities for career advancement in Australia.

Work hard and play hard! Australia's major cities, countrysides, wine regions, outback and mountains, and sandy beaches offer endless opportunities to unwind after a hard day's work.

Contact

STERLING HEALTHCARE RESOURCING PTY. LTD.

ABN 11 604 265 938

ACN 604 265 938

OFFICE

SUITE 504/365 LITTLE COLLINS STREET

MELBOURNE, VIC 3000

AUSTRALIA

PHONE

+61.3.7020.1300 (Australia)

+44.808.175.4357 (UK Toll Free)

+1.877.880.9969 (US and Canada)

FAX

+61.3.7020.1311 (Australia)

Let's Connect

©2015-2023 STERLING HEALTHCARE RESOURCING PTY. LTD. | Terms and Conditions | Privacy Policy